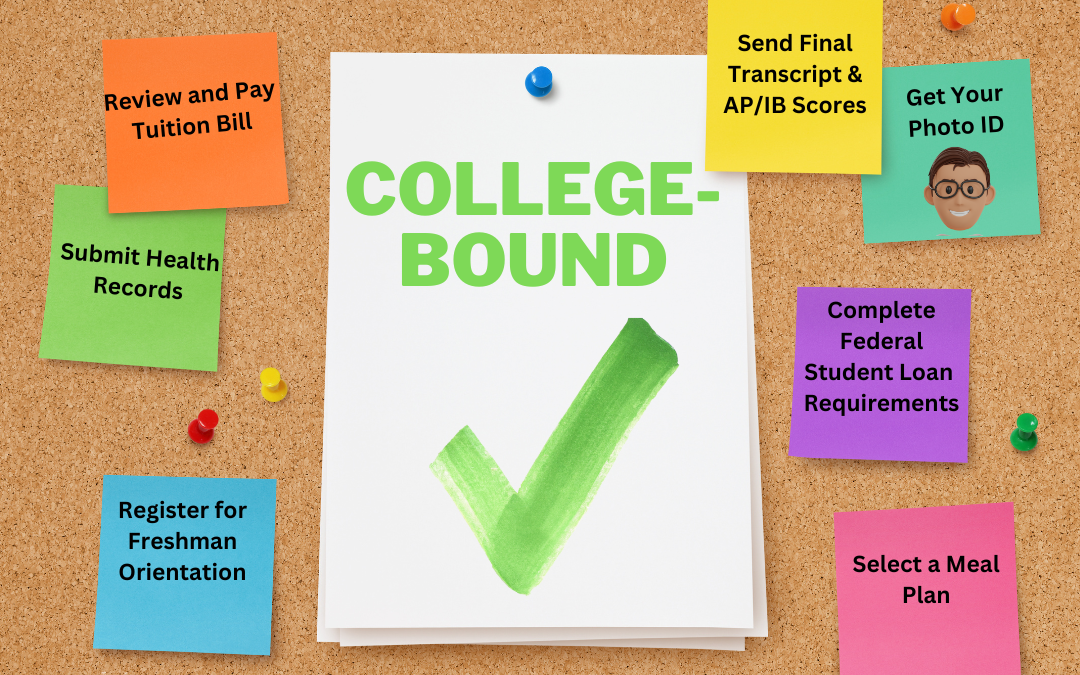

Congratulations, Class of 2025! Your hard work and dedication have paid off, and you’re about to embark on an exciting new chapter in your educational journey. Here’s a clear and concise guide to help you navigate the next steps this summer to ensure a smooth transition to college.

If You Haven’t Done So Yet

- Review Financial Aid: Accept or decline any offered student loans. Visit Federal Student Loans for more information (studentaid.gov).

- Complete Entrance Counseling: Required for federal student loans. Complete the session online at Student Loan Entrance Counseling (studentaid.gov).

- Sign the Master Promissory Note (MPN): Necessary for the first year of borrowing (studentaid.gov).

- Keep Records: Ensure you receive confirmation of completed entrance counseling and MPN.

- Submit Housing Application: If living on campus, complete this as soon as possible.

- Register for Freshman Orientation: Check dates and register through your college’s website.

- Contact Admissions for Help: Reach out with any enrollment questions.

June/July

- Submit Health Records: Required before class registration. Check for immunization requirements.

- Send Final Transcript: Request that your high school forward your final transcript to your college.

- Select a Meal Plan: Research dining options on the college’s dining service website.

- Get Your College Photo ID: Most colleges allow online photo submission.

- Plan for Tuition Payments: Bills are due in late July or early August for fall, and December for spring. Investigate payment plans if needed.

- Submit AP/IB Scores: Send these to your college by July.

- Review Billing Statement: Contact the financial aid department with any questions about your fall semester bill.

Parents – Important Insurance Insight

Understanding Your Child’s College Health Coverage

When reviewing your child’s college invoice, it’s crucial to pay close attention to the health insurance section. Many colleges automatically enroll students in their own health insurance plans, which can lead to unexpected charges if not addressed. College health insurance costs typically range from $1,500 to $3,500 per year. The cost varies based on the institution, the type of plan, and the included services.

Parents should explore whether the school’s health plan is necessary or if a waiver can be submitted to use existing coverage. Understanding these options ensures you’re not paying for redundant insurance and helps maintain proper healthcare coverage for your student. Consult with the college’s health services office if you have questions.

Students – Following these steps will help you prepare effectively for your first semester of college. Stay proactive, communicate with your college, and don’t hesitate to seek help when needed.

Good luck with this exciting next chapter in your academic journey!