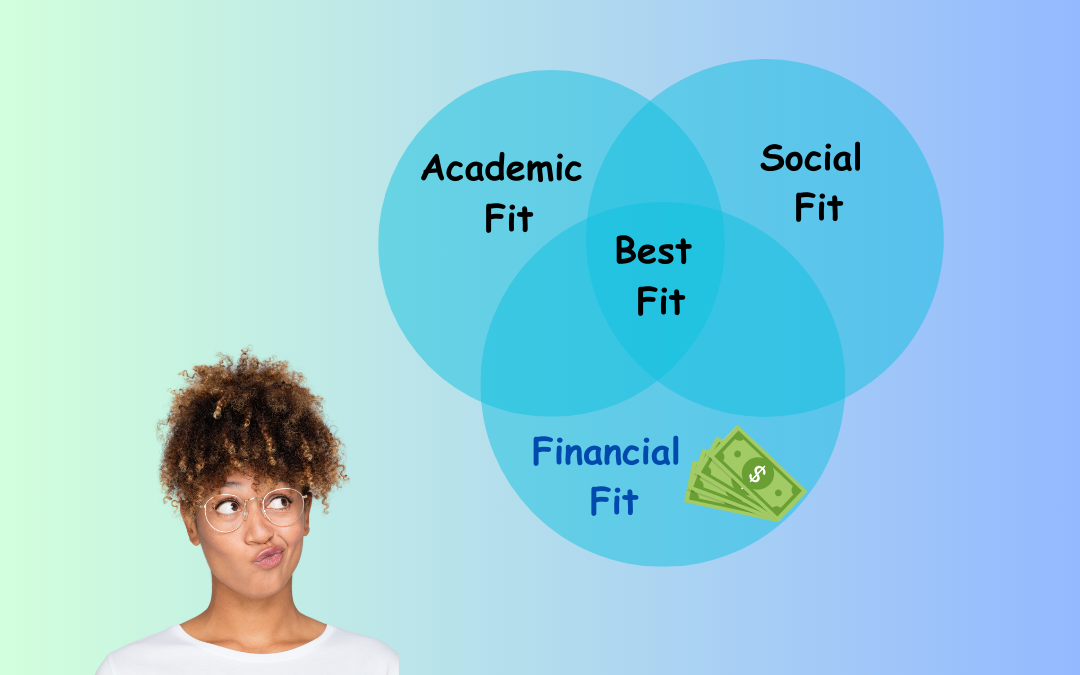

What does “fit” mean?

When you shop for pants, the “fit” is not just about whether you can get them on. It involves other factors such as color, quality, appearance, and cost.

College fit includes factors such as geographic location, GPA, SAT/ACT scores, academic programs, activities, student-to-teacher ratio, graduation rate, employment statistics, and support services.

You should also consider the cost as a major factor. Is a college affordable to your student and your family? Consider this factor early in the college search process. Dealing with this issue ahead of time is crucial — don’t wait until you’re struggling with unaffordable college acceptance letters. The decision can cause family feuds; don’t let emotions lead you to an unaffordable college choice. I caution my families about even visiting colleges they cannot afford.

Consequences of selecting a college your student can’t afford:

- Your student may not be able to complete the program.

- Parents may use their retirement savings. Some or all of the money may be taxable. You may have to work longer. There may be a penalty fee if you are not using IRA funds. Additionally, the funds withdrawn from retirement can count as income and may reduce the need-based aid your child receives two years after the withdrawal; if you are considering this option, be sure the timing is strategic. Always consult your financial advisor.

- Parents and students may rely more heavily on student loans to fund their education. This debt can significantly impact your life and your student’s life.

It is important to note that students are limited in the amount they can borrow in federal direct student loans during their undergraduate years. Additional education loans required to pay for college will most often require a parent co-signer.

Student loans can significantly delay life goals like marriage, children, and home buying. I remember reading an article in the June 2016 edition of Consumer Reports magazine. Although it may be dated, its message remains powerful and relevant. Please take a moment to read the article, ” Student Debt – Lives on Hold” Consumer Reports. https://www.consumerreports.org/student-loan-debt-crisis/lives-on-hold/

It is crucial to consider financial fit during the college search process; disregarding it could be detrimental to both you and your student.

Next week, I will address how to estimate your net price cost for a college. The good news is that most students pay less than the published cost of a college.

Sentinel Article November 16, 2023